For B2B buyers — whether brands, importers, or distributors — the implications go beyond higher fees. Extended testing lead-times, increased rejection risk and disrupted delivery schedules challenge traditional sourcing models. The need now is for an integrated toy supply chain that ensures compliant, tested and timely products.

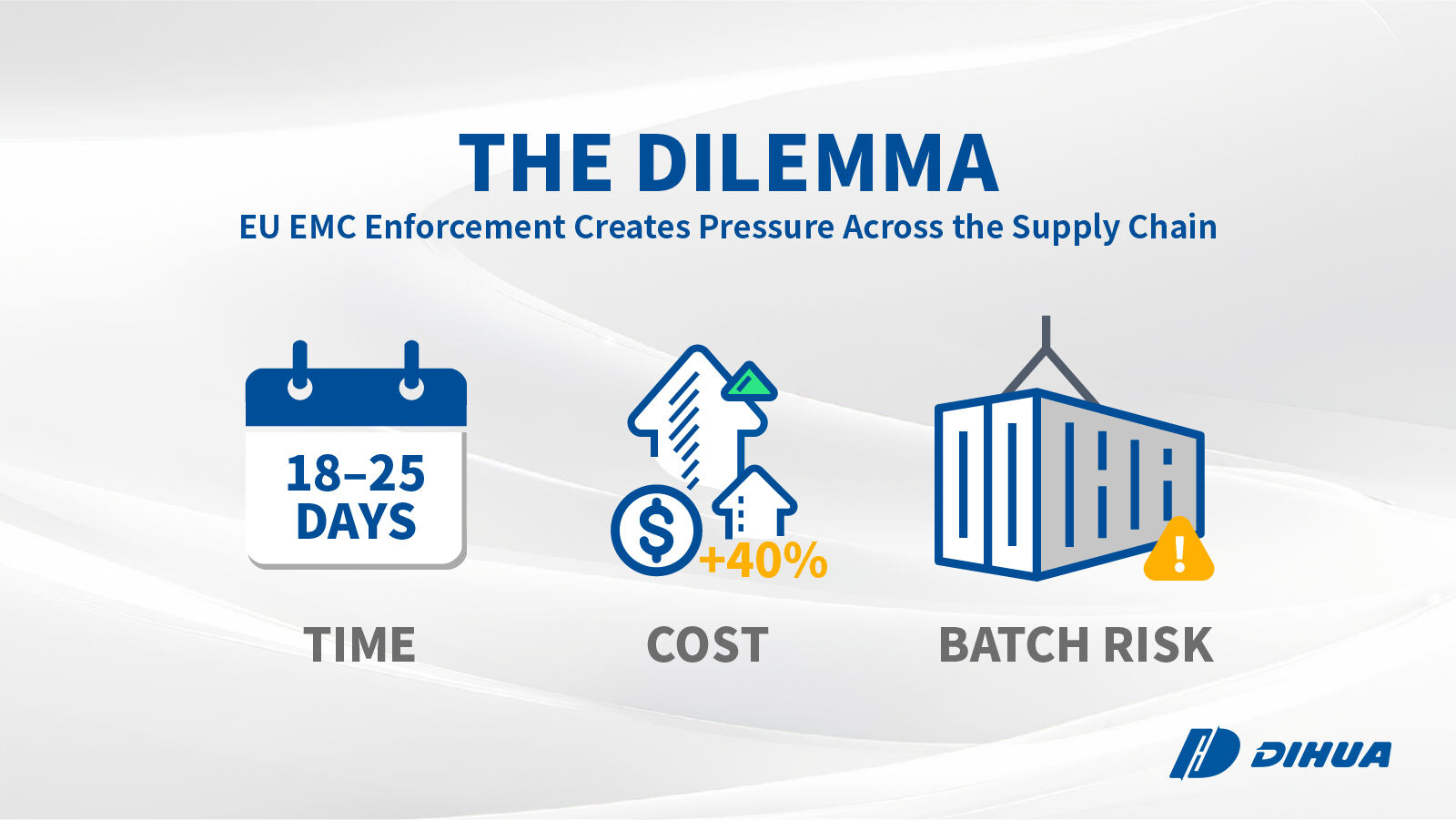

Stricter enforcement of electric toy safety standards — including EN 62115 and related harmonized directives — is reshaping the operating landscape for OEM and ODM toy suppliers. Balancing electrical safety, EMC compliance, digital documentation, and market delivery timelines has become increasingly complex. These challenges can be summarized across three critical dimensions: development and testing cycles, compliance costs, and batch-level market risks.

Under the new EN 62115 standard, testing windows have lengthened to 18–25 days → lab waitlist, with additional queue time during seasonal peaks,delaying every stage from prototype approval to shipment scheduling. Each extra week in the queue impacts tooling, packaging, and delivery coordination—putting pressure on time-sensitive orders, especially during pre-holiday production peaks.

The stricter enforcement of EN 62115 and the rollout of e-DoC/DPP (Digital Declaration of Conformity and Product Passport) are driving up compliance costs across the electric toy sector. Importers and brand owners are facing higher expenses in testing and documentation management, while retailers must closely monitor product compliance status and launch timelines — collectively increasing operational risks across the entire supply chain.

A single non-compliance issue—be it a failed EMC test or missing documentation—can hold up entire container shipments. The resulting storage, re-inspection, and opportunity costs often outweigh the testing expense itself, translating compliance failures into tangible delivery and sales losses.

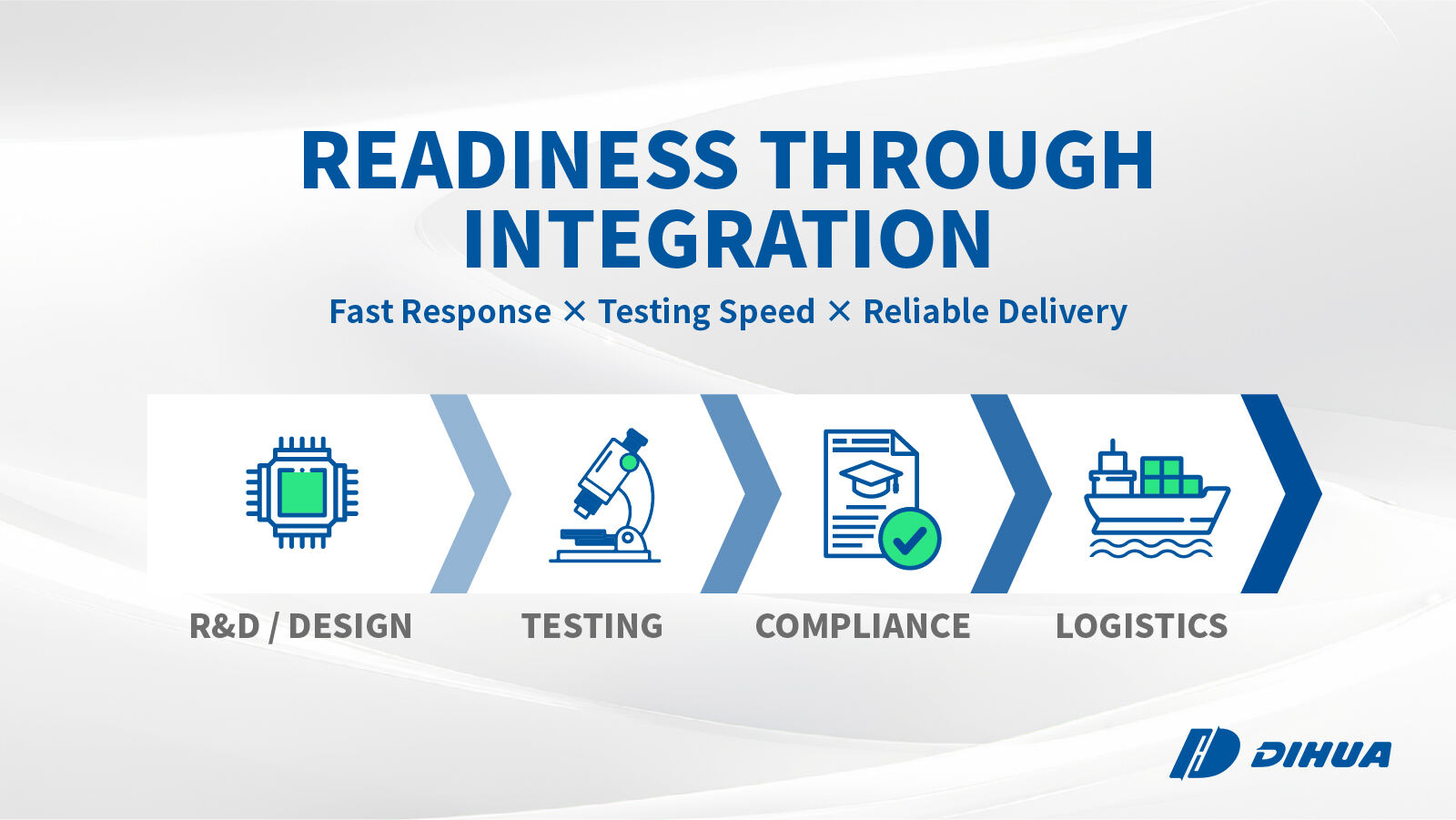

As these pressures converge, compliance has become a strategic differentiator. B2B buyers now seek sourcing partners who deliver not only cost efficiency but also reliability—ensuring tested, compliant, and on-time products through an integrated toy supply chain.This growing divide is reshaping the industry—clearly distinguishing suppliers that struggle to adapt from those that turn compliance into a competitive edge.

· Losers: Fragmented suppliers (factory ≠ compliance ≠ logistics), late EMC at EVT/DVT, single-threaded labing.

· Winners: Integrated partners that design for EMC early, pre-scan in-house, and run lab certification in parallel with tooling — delivering unified compliance packs and slot-secured shipping.

At Dihua, regulatory foresight is built into our integrated toy supply chain. Our compliance and engineering teams work directly with partner factories to assess electrical designs, PCB layouts, and material structures at the concept stage. When standards such as EN 62115 evolve, we evaluate their technical impact and guide early design adjustments to ensure conformity.

This parallel testing model shortens the compliance cycle by 20–30 percent, cutting a three-week process to roughly ten days. It also eliminates costly rework and ensures that every certified batch aligns precisely with production tooling from the outset.

Together, these capabilities demonstrate how Dihua transforms compliance challenges into operational strength. By uniting regulation tracking, testing efficiency under one Factory + Trade Model, we ensure that every product moves from concept to market with speed, consistency, and full regulatory confidence.

· On-Time Delivery: In 2024, Dihua achieved an on-time delivery rate of 96.8% across all OEM and ODM shipments to the EU, outperforming the industry average of 88% (Dihua Logistics Report 2024). Shortened testing and certification cycles—from 25 days to 17 days—were key to this efficiency.

· Testing Efficiency: Through our dual-track EMC + safety workflow, 72% of new electric-toy SKUs completed certification 20–30% faster than the regional benchmark reported by TÜV SÜD Asia (2025).

· Verified Compliance: All products comply with EN 71 and EN 62115 toy safety standards for the European market, as well as ASTM F963 and CPSIA standards for the United States. They are manufactured in factories certified under BSCI, Sedex, ISO 9001/14001, ISO 22716, and U.S. GMP, ensuring smooth customs clearance and regulatory acceptance across both the EU and U.S. toy safety frameworks.

· Client Results: European import partners report a 30% reduction in re-inspection costs since adopting Dihua’s Factory + Trade Model with unified documentation. One major German retailer recorded zero customs holds over three consecutive quarters (Q3 2024 – Q1 2025).

· Early Compliance Planning — Ability to track EMC and toy-safety updates and adjust designs before testing begins.

· Fast-Track Testing Systems — Internal pre-scans and parallel lab certification to shorten approval cycles.

· Integrated Operations — R&D, testing, and logistics managed under one coordinated supply chain.

· Verified Certifications — Proven compliance with EN 62115, EN 71, ASTM F963, and factory audits under BSCI, Sedex, ISO 9001/14001, and GMP.

· Proven Reliability — Documented performance in on-time delivery, reduced re-inspection costs, and zero customs holds.

Dihua recommends completing EMC and toy-safety testing for 2026 samples by the end of 2025 to secure early approvals, stabilize production, and avoid pre-season bottlenecks. Through our Factory + Trade Model, we integrate OEM development, compliance management, and logistics into one coordinated system—helping brands and importers navigate the electric toy compliance EU landscape with speed and confidence.

· Hong Kong Toys & Games Fair 2026 — January 12–15, 2026

· Spielwarenmesse, Nuremberg — January 27–31, 2026

Hot News

Hot News