As global trade uncertainty intensifies, the uncertain outlook for 2026 toy tariffs and fluctuating shipping costs are reshaping how brands, importers, and retailers prepare their SS27 programs. Recent analyses from The Toy Association, McKinsey’s Europe Consumer Pulse, and logistics trend reports from Reuters and AP News highlight a consistent pattern: landed costs are becoming harder to predict, development cycles are lengthening, and procurement teams face rising pressure to secure compliant, on-time shipments. In this environment, a central question emerges for SS27 buyers:

How can we maintain full supply-cycle control for SS27 despite tariff volatility and moving market conditions?

For many companies, the answer lies not only in cost negotiation but in improving visibility and reducing risk across the entire SS27 toy supply chain — from concept validation to warehouse receiving. Below is a structured breakdown of today’s sourcing pain points, key risk nodes, and how Dihua helps maintain stability.

A successful SS27 program starts with recognizing the structural pressures reshaping global sourcing. As trade dynamics shift and compliance demands rise, buyers face interconnected risks that directly affect cost stability, development timelines, and delivery reliability. The points below outline the key vulnerabilities in the SS27 supply cycle.

· Tariff volatility destabilizes cost planning

Even minor changes in tariffs or duty classifications can significantly alter landed cost projections. Buyers working with seasonal margins or competitive retail environments find their SS27 forecasts challenged before production even begins.

· Long development cycles heighten inventory and cash-flow pressure

A full toy product cycle — including ODM design, engineering validation, tooling, compliance testing, and mass production — commonly stretches 90 to 150 days. Any disruption within this timeline can compress the SS27 launch window and increase financial exposure.

· Multi-node coordination creates operational risk

Many buyers must independently manage communication with factories, testing laboratories, packaging suppliers, shipping brokers, and customs agents. Fragmented coordination results in timeline drift, duplicated work, and potential non-compliance.

· Missed season equals missed opportunity

Seasonal assortments, especially spring/summer programs, rely on precise timing. Delays in certification, production, or freight can lead to lost shelf space and reduced SS27 sell-through potential.

Together, these pressures signal a clear shift in SS27 sourcing: the challenge now lies in managing volatility across the entire supply chain, not just controlling cost or capacity. Tariff swings, complex development steps, and multi-node coordination require a more integrated and transparent approach. Addressing these risks early is essential for protecting margins, securing timely approvals, and staying agile enough to capture SS27 opportunities.

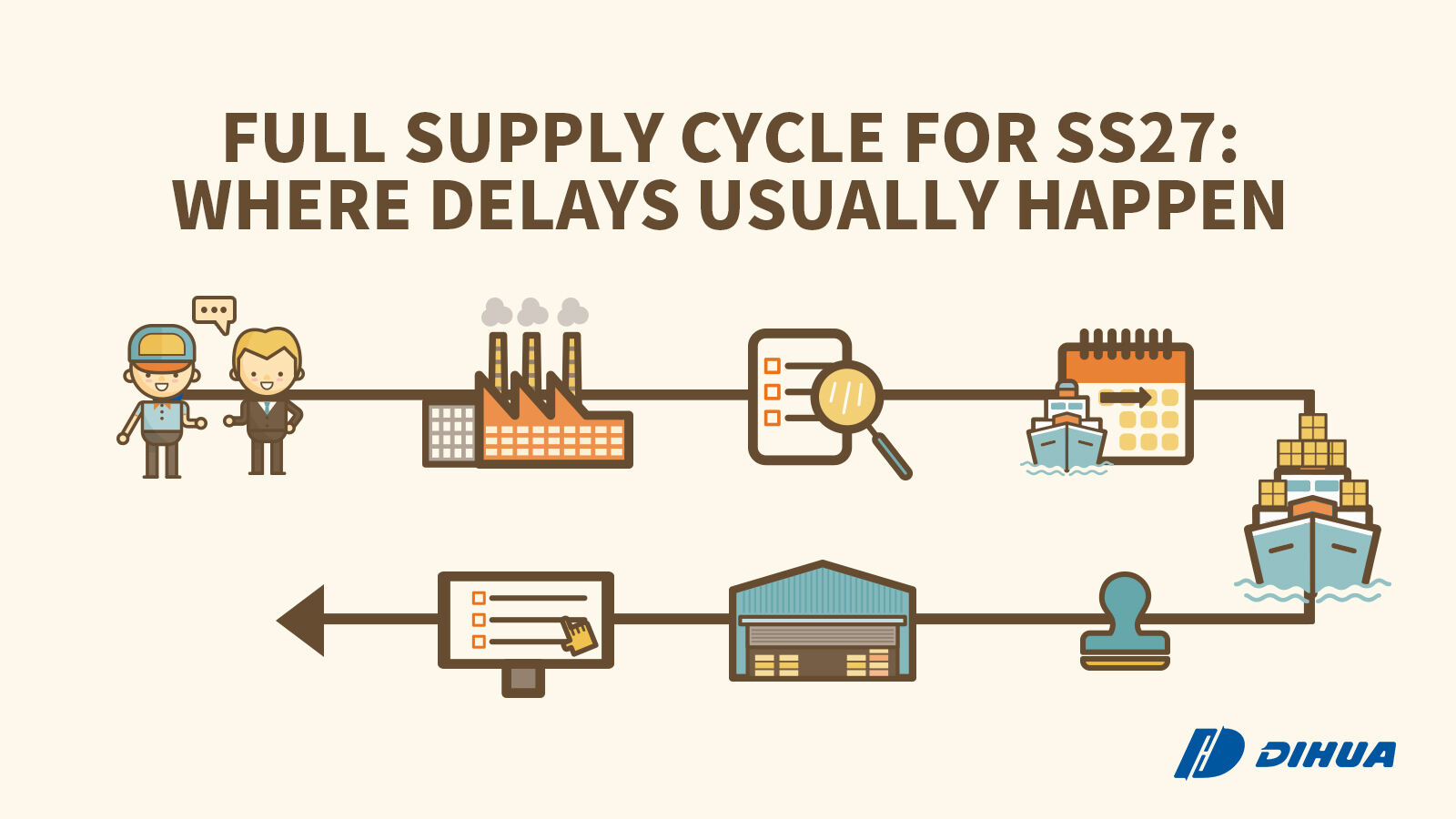

To maintain true supply-cycle control, buyers must understand the full SS27 development-to-delivery timeline and identify the high-risk nodes that require early intervention and tighter oversight. Each stage carries its own operational, compliance, and timing implications.

· Supplier Communication & Order Confirmation

Early misalignment on specifications, functional requirements, compliance standards, or packaging formats can quickly lead to repeated revisions. When these adjustments involve tooling or material changes, the SS27 timeline may shift before production even begins. Clear briefs and structured confirmation checkpoints at the start of the project are essential to prevent downstream delays.

· Production Planning & Material Reservation

The stability of the production schedule is affected by raw material price movements, fluctuating factory capacity, and uneven forecasting. Inaccurate demand planning can result in material shortages or production slot conflicts, both of which compress lead-times and reduce flexibility during peak SS27 development periods.

· Quality Inspection & Compliance Certification

For categories involving batteries, electronics, or light-up features, compliance becomes a critical timing factor. EMC testing, EN71, and ASTM checks frequently create bottlenecks when failures occur. Each test cycle—especially retesting — can add 10–25 days and push shipments outside ideal SS27 windows. Early compliance consultation is therefore key.

· Logistics Planning & Sea-Freight Booking

Even with a completed production run, the logistics phase presents its own volatility. Shipping rates remain sensitive to global disruptions, while port congestion and vessel space limitations continue to impact planning reliability. Late booking or unexpected surcharges can undermine cost projections and force reactive adjustments.

· Shipment & Ocean Transit

Weather patterns, maritime schedule changes, customs documentation checks, and container handling delays all influence actual transit time. These variables extend the uncertainty window between factory departure and arrival at destination ports, directly affecting distribution and allocation plans for SS27 rollouts.

· Import Declaration & Customs Clearance

Incorrect HS codes, missing certificates, or tariff inconsistencies can trigger re-inspection, additional duties, or clearance delays. As tariff classifications under toy tariffs 2026 outlooks continue to evolve, customs preparation has become an increasingly sensitive step in maintaining predictable landed timelines.

· Warehouse Receiving & Distribution

Even after clearing customs, delays can arise during regional distribution. High DC (distribution center) volume, inbound routing errors, or insufficient processing capacity can shift planned availability dates, impacting retailer replenishment schedules and promotional timing.

· Retail Readiness & Listing Preparation

Final delays often stem from commercial preparation rather than production. Missing digital assets, incomplete copywriting, packaging artwork tweaks, or final data-sheet corrections can push listing dates back—sometimes by weeks—resulting in missed SS27 marketing windows.

Dihua operates as a hybrid OEM–ODM–sourcing partner rather than a single-factory supplier, enabling buyers to manage the full SS27 cycle with clarity and confidence.

· Integrated OEM & ODM Capabilities Reduce Early-Stage Risk

· ODM / Design Services — for brands needing differentiation

· Concept feasibility review

· Early compliance advisory

· Cost & material optimization

· Play pattern and structural validation

· OEM / R&D Support — for importers, retailers, and procurement organizations

· Engineering refinement

· Tooling development

· Functional testing and prototype validation

· Risk-based quality assessment

By consolidating design, engineering, and compliance discussions from the start, buyers avoid costly revisions and accelerate SS27 approvals.

· Compliance-First Approach Ensures Predictable Outcomes

Dihua integrates regulatory oversight across the entire SS27 development plan:

· EN71 / ASTM F963 / CPSIA compliance management

· EMC-ready engineering for electric toys

· FSC, GRS, and biodegradable packaging solutions for European markets

· BSCI, Sedex, ISO9001, ISO14001, ISO 22716, U.S. GMP and anti-terrorism audits for large retailers

A proactive compliance approach reduces retest cycles and helps maintain shipment readiness, even under unpredictable conditions.

· End-to-End Supply Chain Tracking Enhances Visibility

Through standardized workflow control, Dihua supports buyers with:

· Real-time production updates

· Consolidated QC reporting

· Booking & freight coordination

· Document preparation for customs & clearance

· Risk alerts for timeline-critical checkpoints

This integrated toy sourcing model allows buyers to reduce cross-vendor miscommunication and maintain stable progress toward SS27 targets.

· Assortment-Building Capability for Retailers & Importers

For companies prioritizing multi-SKU programs, Dihua offers:

· Cross-factory SKU consolidation

· Category-balanced assortment planning

· Carton optimization & freight cost efficiency

· Seasonal program bundling

Stronger assortment capability enables better category breadth and faster product flow in SS27.

· Cost Stability Strategies for Tariff-Sensitive Buyers

While tariffs cannot be controlled, cost structure can be managed through:

· Multi-factory benchmarking

· Packaging volume reduction

· Material substitution options

· Split-shipment strategies for cash-flow optimization

· Early booking & planning to avoid peak-season premiums

These measures help stabilize SS27 budgets even when tariff policies fluctuate.

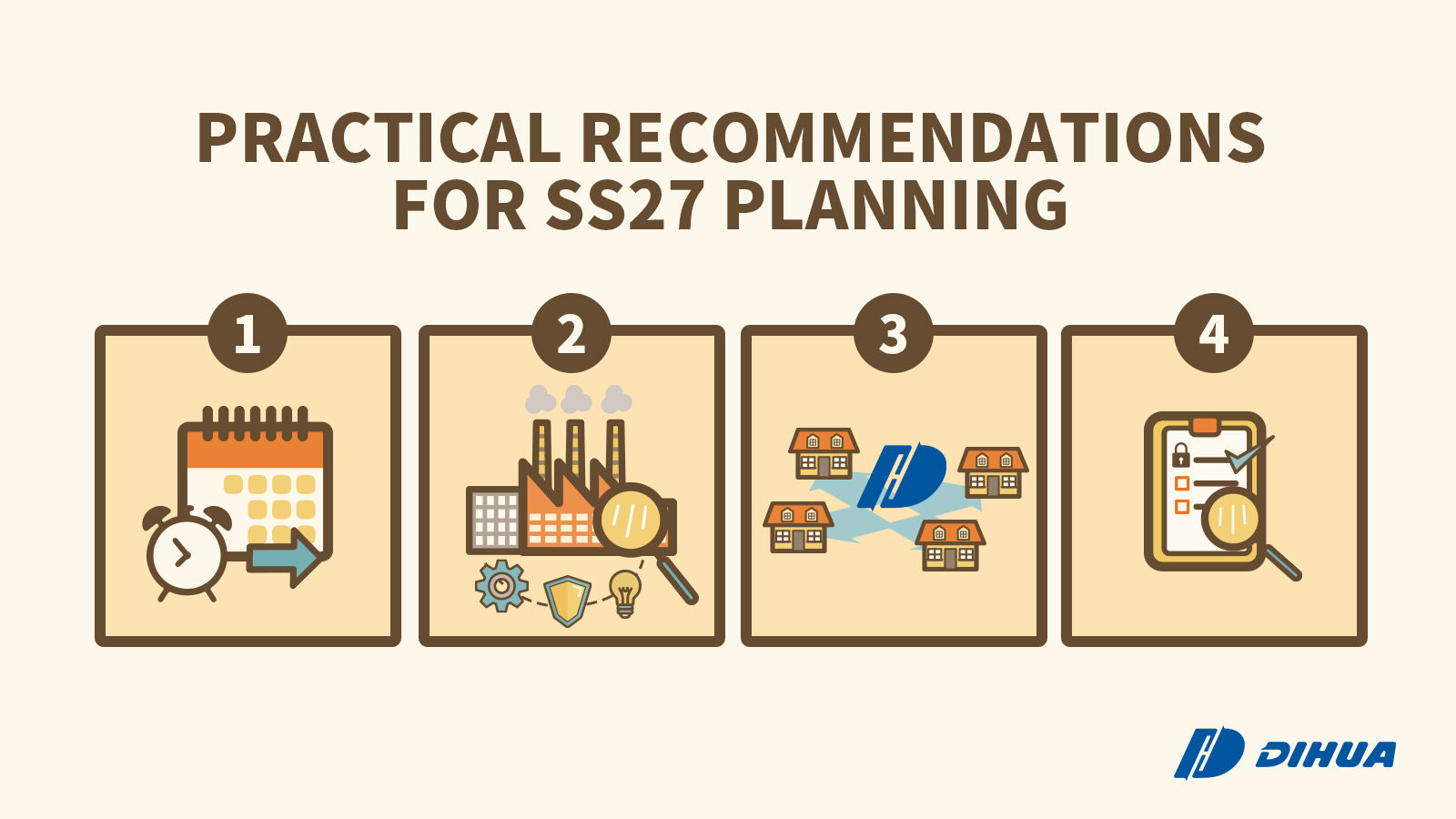

· Start development 2–3 months earlier than previous cycles to create buffer for regulatory checks, tariff changes, and potential retesting. Early kickoffs also allow greater flexibility in design iteration, tooling validation, and material planning.

· Evaluate suppliers by full-cycle capability—not unit price alone. In today’s environment, compliance strength, supply-chain visibility, and schedule control have a greater impact on total landed cost and delivery stability than piece price. Partners with integrated OEM/ODM workflows and in-house compliance expertise can significantly reduce timeline volatility.

· Consolidate coordination points whenever possible to reduce cross-node risk. Managing multiple factories, labs, packaging vendors, and freight agents increases misalignment. A single partner overseeing development, compliance, production tracking, and shipment planning helps maintain a consistent SS27 timeline.

· Conduct early testing and freeze specifications earlier in the cycle. Pre-compliance reviews, early sample evaluations, and structured spec confirmation minimize late-stage revisions, which are the most common source of SS27 delays.

Tariff volatility is only one dimension of the challenge. The real determinants of SS27 success lie in supply-chain transparency, consistent compliance performance, and effective end-to-end coordination across every development and delivery node. By leveraging integrated OEM, ODM, and sourcing capabilities, Dihua helps brands, importers, retailers, and procurement organizations navigate uncertainty while maintaining predictable timelines and cost structures.

If you are preparing SS27 assortment planning and require a full-cycle risk evaluation — including development scheduling, compliance mapping, and freight forecasting — our team is ready to assist.

Learn more at www.dihuatoys.com or meet our team in person:

· Hong Kong Toys & Games Fair 2026 — January 12–15, 2026

Contact Dihua to begin your SS27 planning consultation.

Hot News

Hot News